Why it’s needed

This advanced model was designed to solve the problem of uncertainty of future information when contracting early development deals. The variation of such information has a material impact on the company purchase price, it is therefore attractive to let the final purchase price depend on future parameters. It has been used in an acquisition contract worth about €50m.

What it is

This model has two steps: solution computation and formula generation.

Solution computation

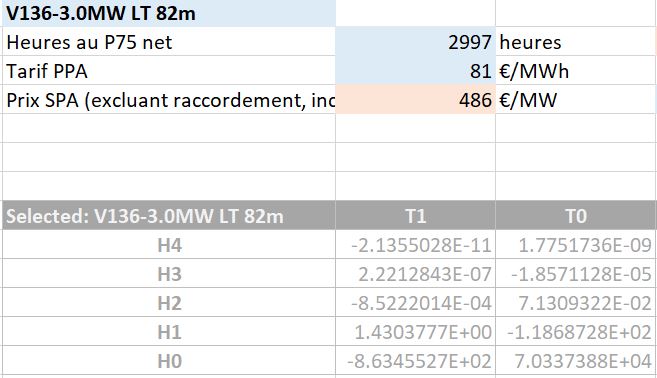

First, the model lets the user input parameters. This includes the main driving factors: type of wind turbines, the average wind speed and the energy sales price (based on specific schemes). It also includes parameters that are known with a higher degree of certainty and that have a lesser impact on final value.

The model then calculates the value of the wind energy project according to specified inputs. The calculation steps include technical parameters, project costs, discounted cash flow model to project future costs and revenues, and financial options.

The output is the sales price of the SPV (special purpose vehicle company that owns the project). This sales price matters because the seller (current owner of the SPVs / project companies) and the buyer (future owner) want to agree on a reasonable price.

Formula generation

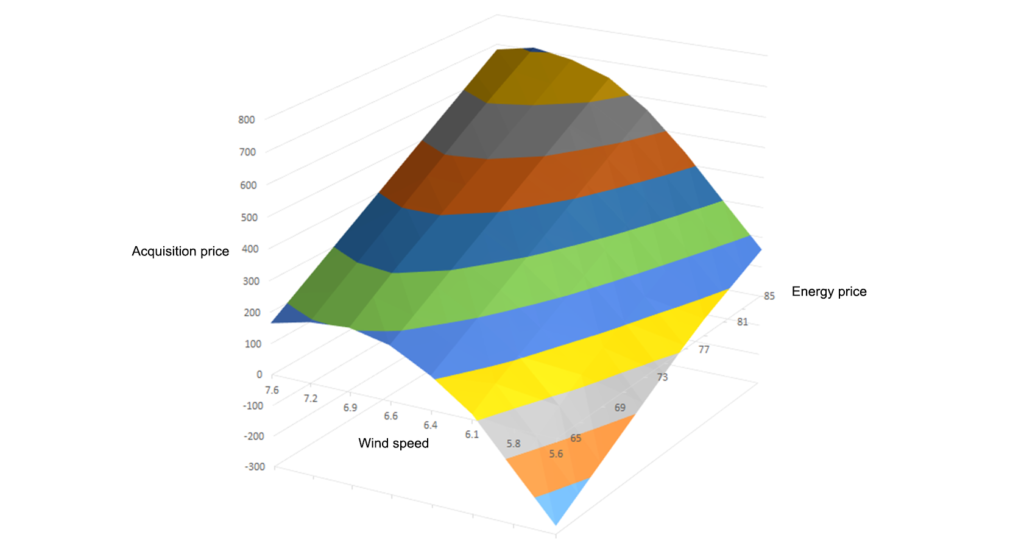

The innovative part of this model is that it doesn’t just calculate a single value as an output. Instead, it generates a formula that takes as inputs the two driving parameters: wind speed and energy sales price. These two values are unknown at the time of contract signature, hence the sales price needs to be established later using the formula.

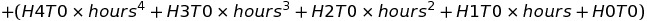

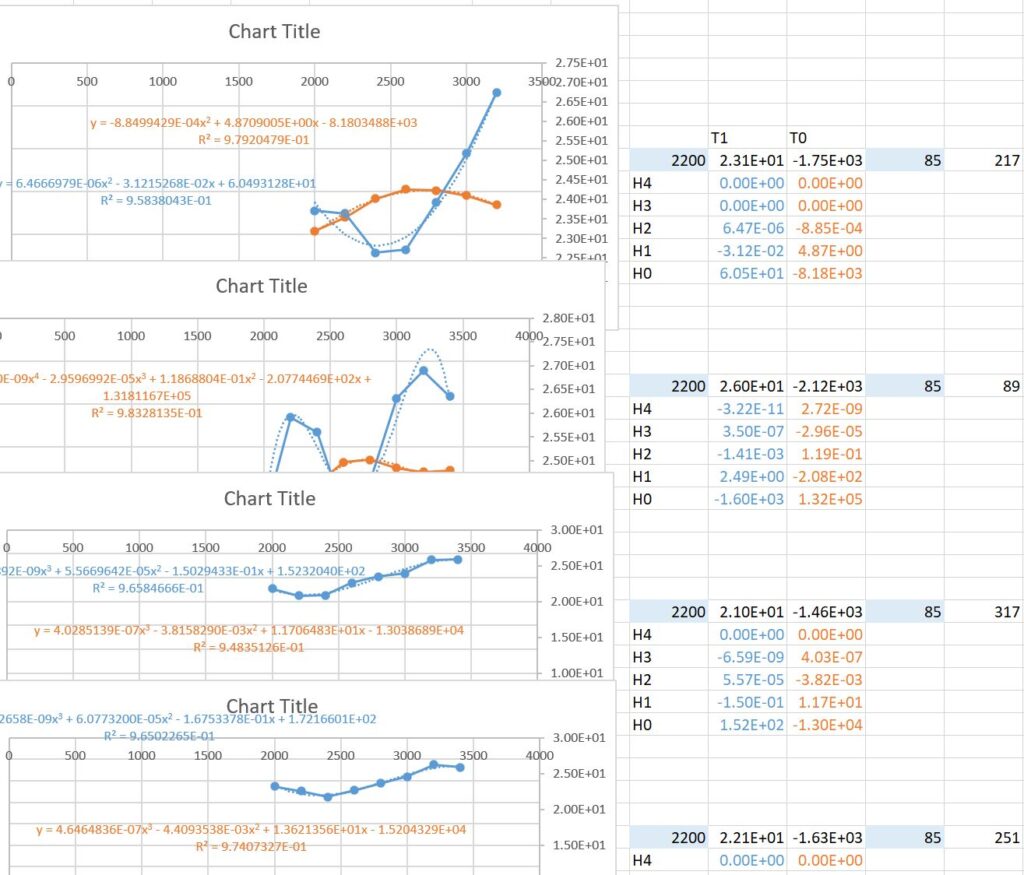

To generate this formula, the model first calculates 10000 cases (100 wind speed options and 100 price options). It then uses polynomials to the 4th power embedded in polynomials to the 1st power to approximate the result in one single formula.

This essentially reduces a 3D field composed of 10000 datapoints into a 2-parameter formula

Price refers to the SPV sales price, which the buyer needs to pay to acquire the project company.

Hours refer to the number of full load hours that the wind turbine can produce per year when installed at a given project. This is a proxy to the wind speed, and a more accurate and useful metric.

Tariff is the energy sales price at which the energy will be sold onto the grid.

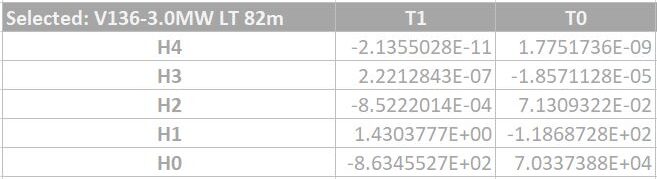

A set of 10 parameters HxTx are generated by the model and included in the contract.

Find below screenshots of the model.

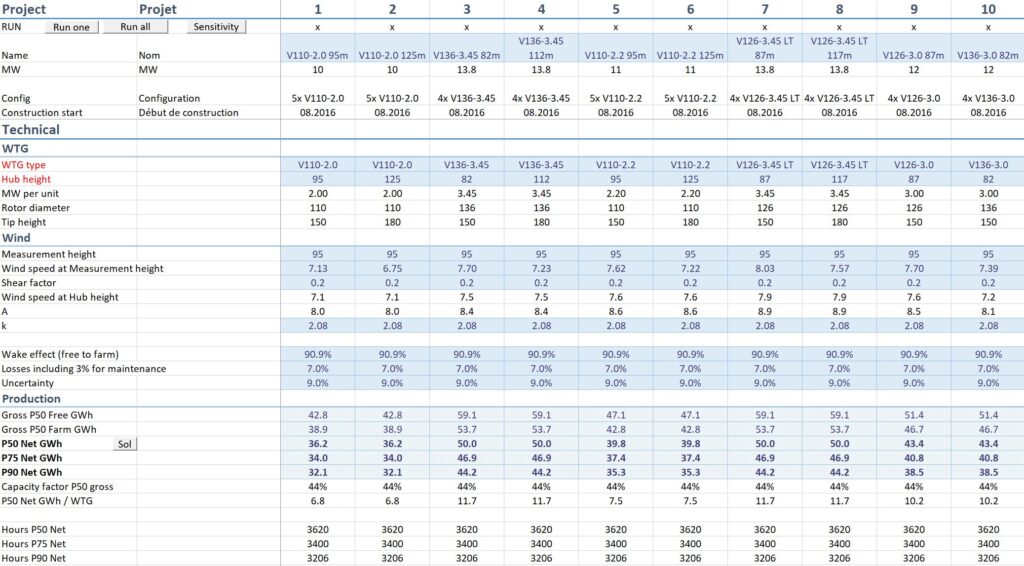

Technical

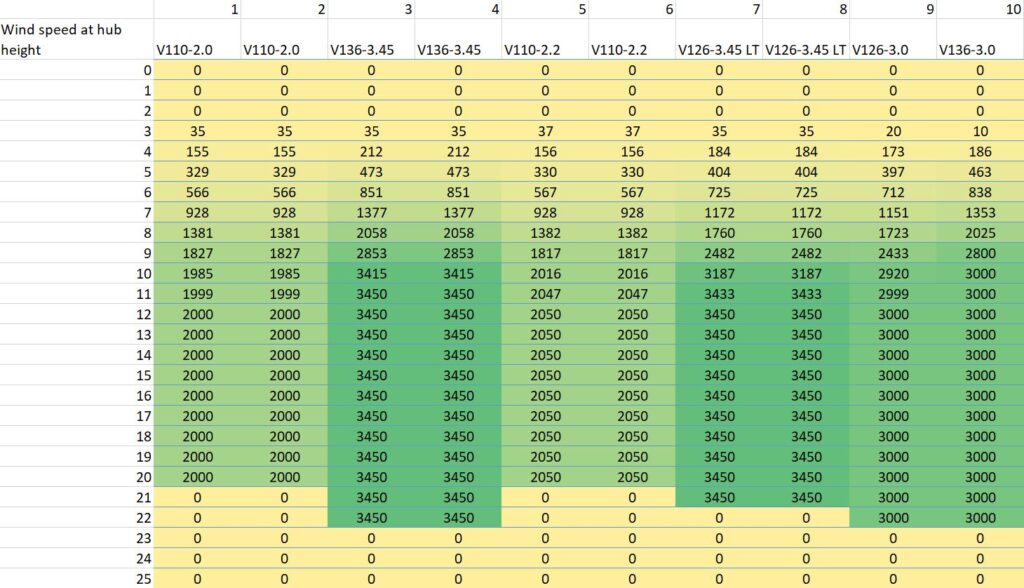

Wind turbine power curves

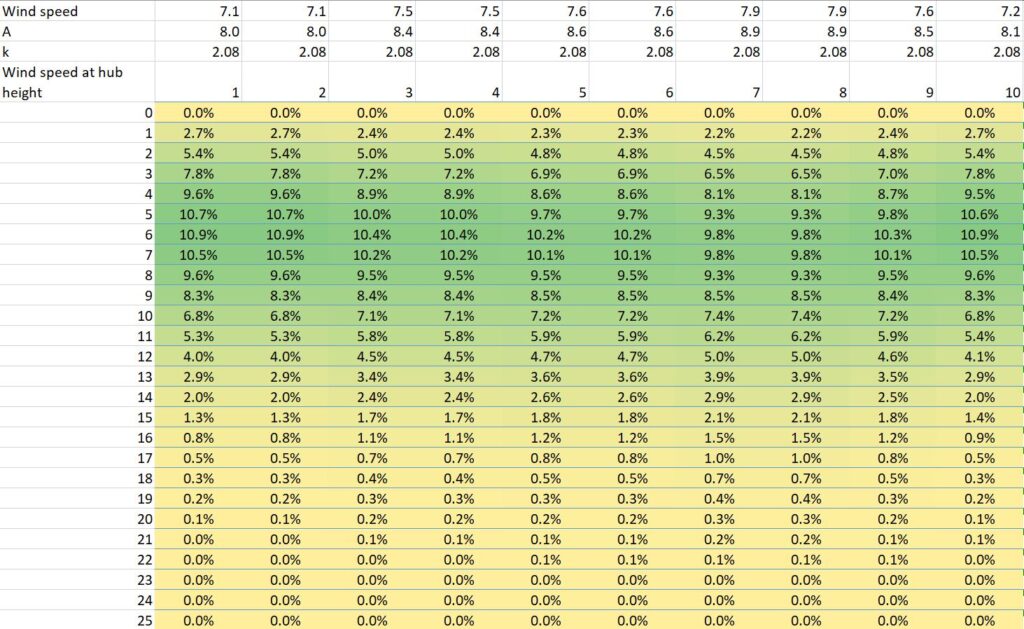

Site wind speed

Energy generated

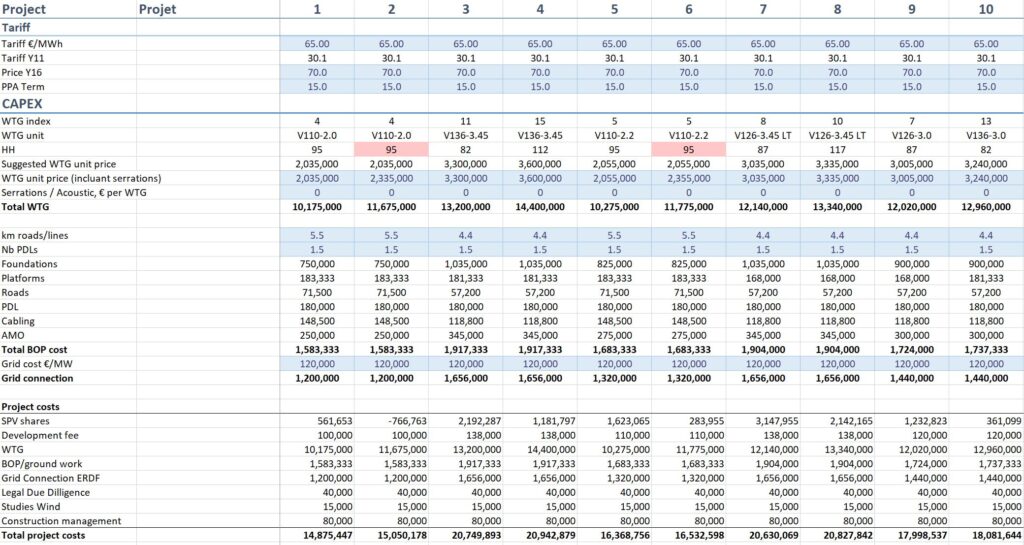

Economy

Technical data

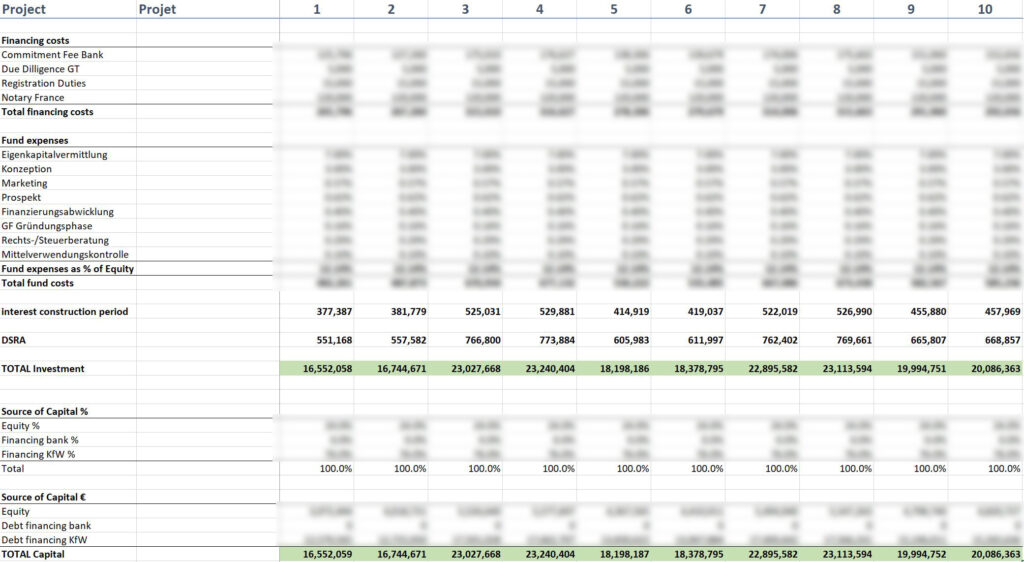

Project costs

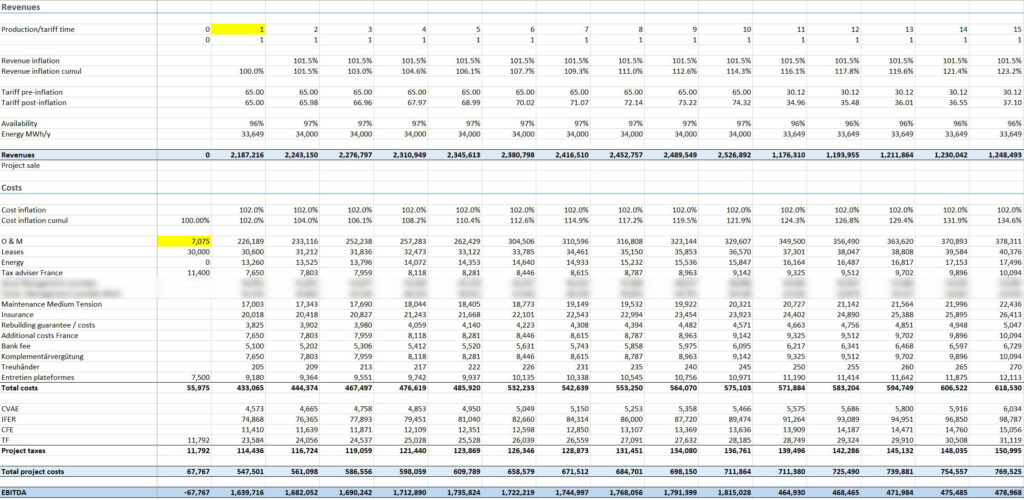

OPEX and revenues in Discounted Cash Flow model

Financial options

Formula generation

Polynomial modeling based on 10000 cases

Formula neatly integrated in an Excel file for contractual use between seller and buyer.